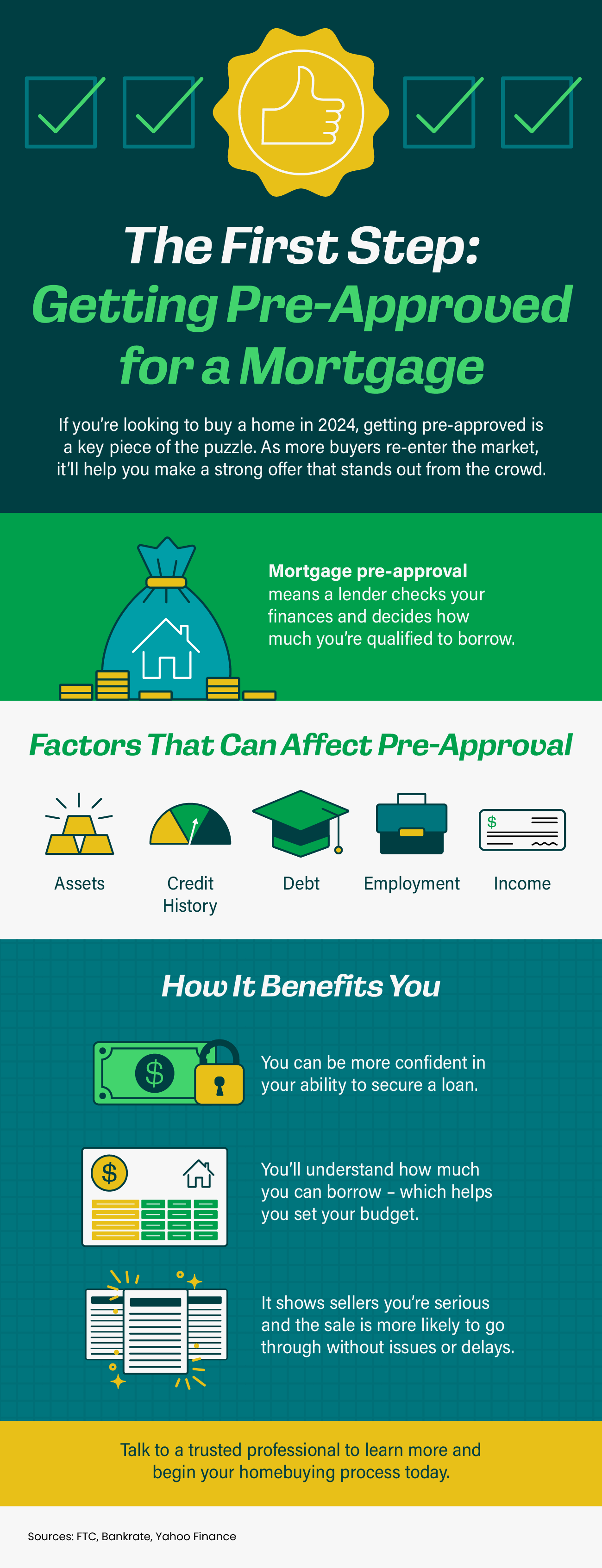

The First Step: Getting Pre-Approved for a Mortgage

Some Highlights

- If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow.

- As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd.

- Talk to a trusted professional to learn more and begin your homebuying process today.

Categories

- All Blogs 324

- Affordability 22

- Agent Value 42

- Buying Tips 86

- Downsize 4

- Economy 20

- Equity 24

- First-Time Buyers 47

- Fishers 1

- For Buyers 186

- For Sale By Owner 6

- For Sellers 124

- Forecasts 15

- Foreclosures 7

- Home Prices 64

- Inventory 43

- Luxury/Vacation 2

- Mortgage Rates 59

- Move-Up 3

- New Construction 8

- Rent vs. Buy 12

- Selling Tips 67

Recent Posts

Why You Don't Want To Skip Your Home Inspection

Does Your Current Home Fit Your Retirement Plans?

The Truth About Newly Built Homes and Today’s Market

House Hunting Just Got Easier – Here’s Why

Things To Avoid After You Apply for a Mortgage

Things To Avoid After You Apply for a Mortgage

The #1 Thing Sellers Need To Know About Their Asking Price

Townhomes: A Smart Solution for Today’s First-Time Buyers

Here’s What a Recession Could Mean for the Housing Market

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again